North African broadband markets, visualized

A World Bank report on the state of the Middle East and North Africa’s broadband landscape examines how to develop each market through a combination of policy, infrastructure, and competition. Instead of summarizing the lengthy report, we’ve taken key visuals and dissected their significance.

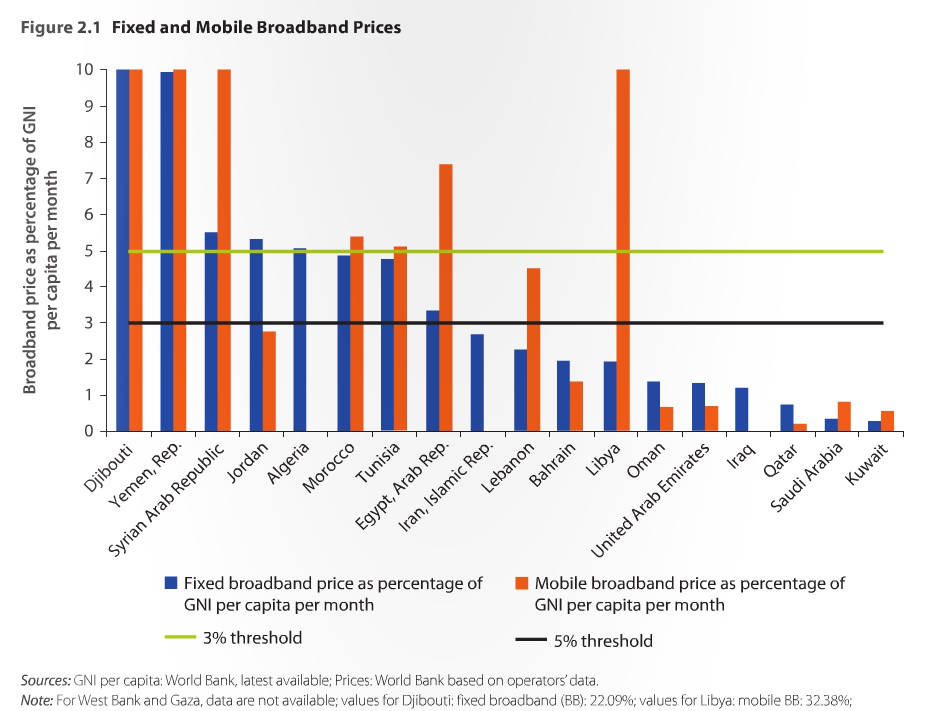

Broadband seems to mean something different in every North African country. In Algeria, Morocco, and Tunisia, fixed broadband is relatively common but is less affordable by regional standards. Egypt and Libya, on the other hand, have better priced fixed broadband, though Libya’s is no doubt less reliable. Djibouti has limited broadband options due heavily in part to a lack of telecommunications privatization.

Even though North Africa can be characterized by having some level of fixed broadband access there is less to say about mobile broadband availability. Mobile broadband is generally more expensive than fixed, especially in Egypt and in Libya. Some nations, like Algeria have only recently gotten 3G mobile access.

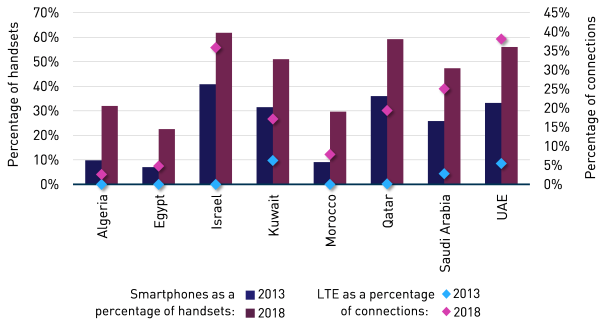

Speaking again to mobile access, Analysys Mason finds that although smartphone ownership in North Africa is extremely low as of 2013, the percentage of smartphone handsets will rapidly increase by 2018. Still, even four years from now no more than 30% of handsets will be smartphones in North Africa. In addition, few North African mobile users – generally less than 10% – will have an LTE connection in 2018.

{Smartphones as a percentage of handsets, and LTE’s share of total connections, MENA, 2013 and 2018 [Source: Analysys Mason, 2014]}

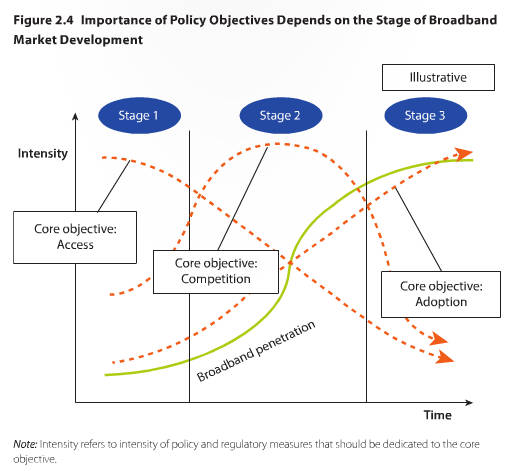

To encourage greater broadband adoption, policy makers must employ three stages of varying intensities. The first goal, broadband access, should start with intensity and last with declining intensity throughout the long-term broadband adoption process. The second stage, fostering competition, should be a primary focus once efforts to improve broadband access are underway. At the same time, effort should be made to strengthen attention on the third goal, which is broadband adoption. Once competition and access are present, broadband penetration should quickly increase before again leveling out.

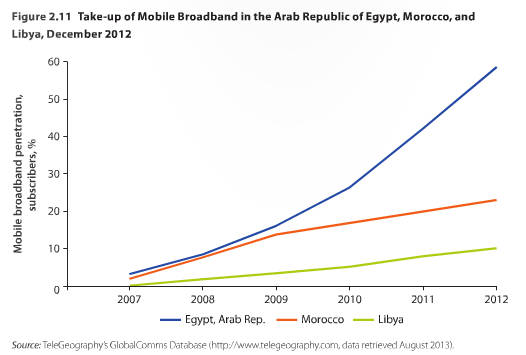

Mobile broadband penetration began to increase at a faster rate in Egypt in 2010. Morocco and Libya have not seen much take-up of mobile broadband. As of 2012, Libya didn’t even have a double-digit mobile broadband penetration rate.

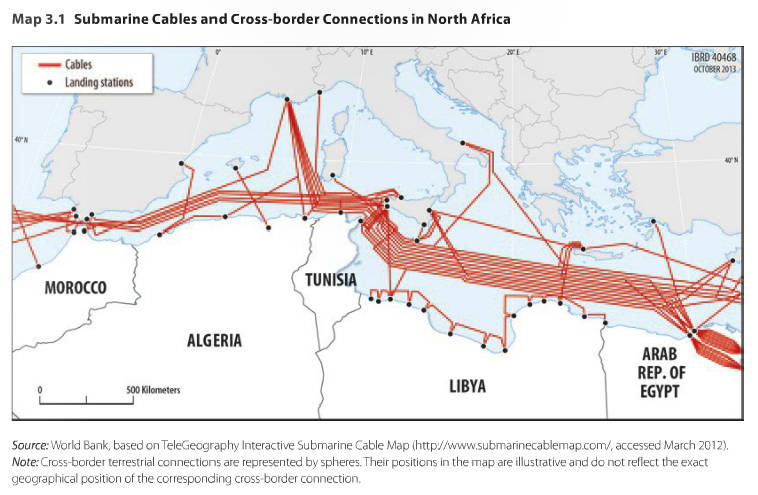

Multiple cables link North Africa with Europe due to the relatively short distance across the Mediterranean Sea. Not pictured are individual maps of national fibre networks.

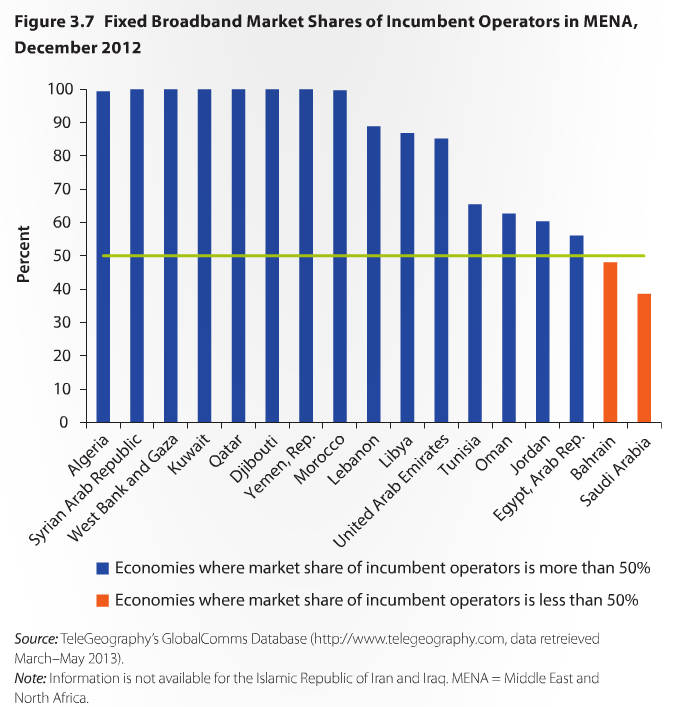

North Africa has an extremely high rate of incumbents dominating the fixed broadband market. In Algeria, Djibouti, and Morocco, the fixed broadband market is monopolized by an incumbent telco. The situation isn’t much better in Libya, through in Tunisia and Egypt the incumbent hardly owns a majority share of the market.

Source: Gelvanovska, Natalija, Michel Rogy and Carlo Maria Rossotto. 2014. Broadband Networks in the Middle East and North Africa, Accelerating High-Speed Internet Access. Directions in Development. Washington, DC: World Bank. doi: 10.1596/978-1-4648-0112-9. License: Creative Commons Attribution CC BY 3.0.

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest