African smartphone usage driven by savvy young South African, Kenyan, and Nigerian consumers

Ericsson continues to closely study the proliferation of mobile access across Sub-Saharan Africa. A recent report from the company’s ConsumerLab platform doesn’t necessarily have any groundbreaking findings, but the key points are worth a second mention. Note that for the purpose of the report (and many like it), Sub-Saharan Africa actually consists of only six countries: Nigeria, Ghana, South Africa, Kenya, Senegal, Cameroon.

In summary, smartphone usage is driven by South African, Kenyan, and Nigerian consumers under 30 years of age who work full time or are still in school and own a smartphone costing less than USD 150. Major driving factors affecting smartphone adoption are affordability, environment, awareness, and infrastructural support. Above all, youth will drive the change – their willingness to share social media usage, instant gratification, and a desire to have the latest technology products will help.

Feature phones still dominate smartphones in terms of adoption – something that is often forgotten in press releases and LTE announcements. Lower cost smartphones are beginning to enter certain markets but usage is still limited. Other than voice, SMS still is used more frequently than social networking or browsing the internet.

Mobile financial services have, in many cases, “put Africa on the map.” Educating consumers on advanced mobile money solutions will be key in driving even greater levels of engagement, however. Eventually, more consumers will use mobiles to pay for school fees, food, and fuel.

Lastly, apps will evolve beyond entertainment and communication. They already are filling voids in crucial sectors like education and agriculture, but institutions like schools and governments need to play an important role in driving ICT adoption.

Specific data on the range of themes covered by the report is worth going over as well:

- Fewer than half of smartphone owners use the internet on a daily basis

- 44% of consumers want to upgrade to a smartphone in order to surf the internet (34% to go on social networking sites)

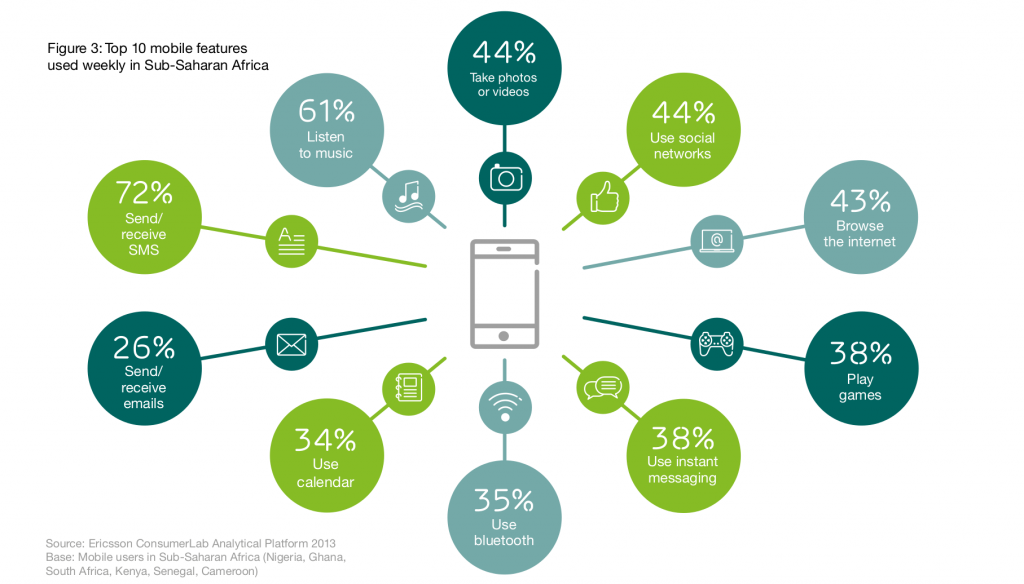

- Weekly, top mobile features used in SSA are SMS (72%), music (61%), photos (44%), social networking (44%), internet (43%)

- Roughly 27% of mobile users between the ages of 16 and 30 browse the internet on their mobile phone

- 56% of consumers who are not currently using the internet on their phone show strong interest in doing so in the future

- Mobile banking is most commonly used for receiving bank card notifications (18%), buying airtime (14%), and transferring money (10%)

- Drivers of mobile banking are speed (61%), lack of queues (42%), security (37%)

- Barriers to mobile banking are lack of security (24%), risk of losing the phone (17%), lack of knowledge (16%)

- Ownership of entertainment apps greatly exceeds interest in productivity apps – but more phone owners aspire to use productivity apps in the future

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest

good for http://www.beeptool.com project