The complex future for mobile telecoms in Africa (consumers are starting to win out)

Deloitte recently completed an in-depth analysis of the African mobile telecommunications market. The report titled, “The future of Telecoms in Africa: The ‘blueprint for the brave’,” aptly covers all aspects of the current mobile telecoms business in Africa, from recent trends to operational strategies to new opportunities.

After much thought, Deloitte feels that due to the rapid growth in mobile connectivity, the way telecoms business is done will change. For one, competition necessitates lower end user prices and a greater array of useful services. Greater bandwidth and infrastructure sharing are also contributing to more reasonable access costs. Questions remain how telcos will embrace these changes (namely, how will they continue to profit amid increased competition and challenging local business environments) but the outlook is surely positive for African consumers.

A summary of dozens of highlights from the report are below.

Four potential market scenarios:

- Markets consolidate faster than all but one operator can respond

- Operators continue to fight for profitability (and banks against mobile payment competition)

- New entrants add greater value than traditional carriers

- Will telcos or global tech groups/banks/media/advertisers/retailers win the hearts of consumers?

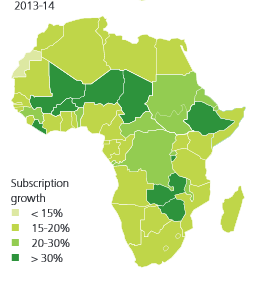

High level mobile subscription trends:

- Recent compound annual growth rate of mobile subscriptions has approached 20%

- Mobile services not only improve lives but impact incomes as a GDP contributor

- Deloitte and GSMA find that a 10% increase in mobile penetration in developing countries leads to a 4.2% increase in productivity

- Mobile subscription penetration in Africa averaged 72% in Q3 2012 but ranges widely and multi-SIM ownership (as high as 2.4 per user in Nigeria) skews the number

- High growth markets include those with high subscription growth like Nigeria or those with high net revenue potential like South Africa or Egypt

Future subscriber growth will be driven by:

- lower call prices and lower cost of ownership of handsets

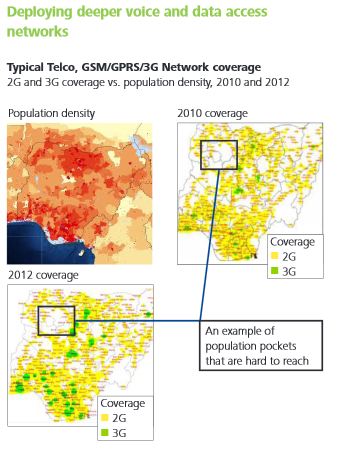

- better rural network coverage and better models of serving these areas

- mobile data connectivity

- mobile operators risking margins to reach out to niche population segments (e.g. rural, late-adopters)

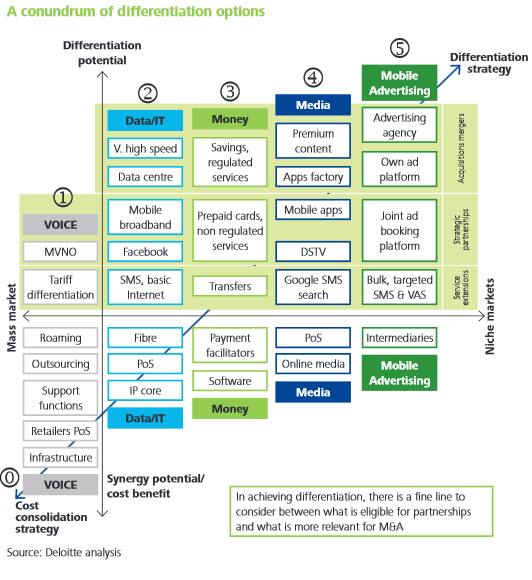

Voice is still the major revenue driver by a large margin, is being commoditized, and competition/regulation is reducing the average revenue per user. Service diversification is the key to maintaining revenue growth: data, business services, mobile apps, mobile advertising, banking.

Tariff innovation has become more complex as telcos use it to maintain share, stimulate demand, and migrate towards data (it has hurt profitability in recent periods too):

- As a differentiator, allows telcos to capture low end of the market (but at lower ARPU)

- Can stimulate usage, secure fixed spend, encourage service bundling

- Freebies are a key offer

- New tariffs have an adverse effect on markets and can easily hurt an operator’s top line (and competitors’ reactions can too)

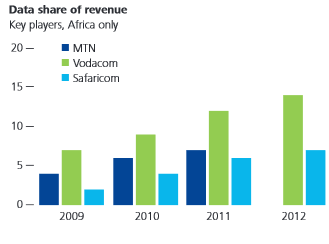

Between 2007 and 2011, Africa saw the second highest compound annual growth rate in total bandwidth usage (85% vs. 98% Middle East). Data’s share of operators’ revenues is still under 20% but is rising as better infrastructure contributes to declining prices, demand met by increased supply, and increased quality of service. Early adopters consume many data services on mobile or fixed. Mass market adoption will increase as the middle class grows and richer entertainment applications emerge.

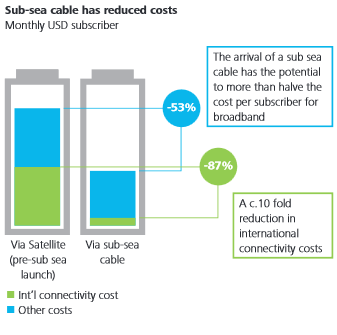

Up to half the price of fixed broadband can be attributed to international connectivity. Between 2009 and 2012, the launch of six submarine cables led to an 87% drop in international data costs at launch. Satellites have been launched as well, reducing access costs by 53%. Local peering and attempts to produce local online content can reduce the need for international data but scale is difficult. A $15/month price level often signals the beginning of mass adoption in African markets.

Domestic infrastructure (national telecoms backbone) is essential delivering broadband access deeper within a country:

- Many nations have submarine cable access but few have delivered this capacity to domestic regional hubs

- Public-private partnerships can act as market catalysts but must be consistent with general policy making

- Public institutions can play a role in managing infrastructure sharing

Voice coverage is adequate in most parts of Africa, but mobile data is lacking outside the most affluent urban centers. Numerous technologies are competing for internet customers, depending on the intended customer segment. Alternative operating models are needed for rural areas, though. Another challenge is weighing benefits of LTE or 3G for markets that have not yet launched 3G services.

IT services are starting to mature with improvements in data connectivity. African states may not be ready for cloud-based services, but they are in many cases ready for data centers.

Mobile money is now a lucrative business endeavor for mobile operators. Nearly all major mobile operators have a mobile money offering (none are as successful as Kenya’s M-Pesa, though):

- Apart from revenue, mobile money keeps users on the network

- The vast majority of urban adults in Kenya have sent money via mobile. In Nigeria and South Africa the number is under 50%.

- Successful mobile money services require cooperation among many stakeholders: operators, retailers, utilies, employers, banks, consumers

- Look for mature services soon: mobile-only banks, micro-finance, m-insurance

The African mobile advertising market could be worth $1.3 billion by 2016 (up ten-fold from $136m in 2012). Smartphones still are not common in Africa (they represent hardly 25% of phones in even South Africa), but their fast adoption will only encourage advertisers, agencies, networks, and operators.

Key drivers for mergers and acquisitions + current opportunities include:

- Cross border and in-country mergers to reduce operational costs

- Divestment from non-core functions (examples include selective outsourcing)

- Diversification of telecoms services (acquiring ISPs and data centers)

- General themes of consolidation, new licenses, and mobile money

Current opportunities for mobile operators (fixed and mobile privatization):

- Ethiopia – MTN and Vodacom have set up business, private firms can offer non-voice services

- Comoros – privatization of Comores Telecom

- Niger – buyer for Sonitel and Sahelcom

- Zambia – opportunity for another operator to acquire a stake in Zamtel

- Madagascar – fixed incumbent Telma was reportedly for sale, plan fell through but this could again change

- A handful of other deals in progress as well

Current opportunities for mobile operators (licenses):

- Nigeria – recent 2.3GHZ spectrum license for Bitflux

- Sudatel – considering expanding to Chad, Niger, and Mali

- Togo – licensing for a MVNO

- Angola – third mobile license

- Sao Tome & Principe – second telecoms license and ACE cable capacity

Source: “The future of Telecoms in Africa: The ‘blueprint for the brave’,” Deloitte & Touche, 2014.

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest