Tigo sees growth in data and financial services but faces regulatory effects

A recent Q3 financial report from Millicom, which in much of Africa operates under the brand Tigo, nicely highlights mobile trends across the continent. Positive trends include growing revenue through data services and mobile money while still adding new customers. Challenges include growing profits, maintaining average revenue per user, and battling external factors like taxes and regulatory decisions (like SIM registrations).

Millicom’s global results (which includes six Latin American nations along with Chad, DR Congo, Ghana, Mauritius [Emcel], Rwanda, Senegal, and Tanzania) look fairly healthy with the company aspiring to become a “digital lifestyle provider.” The company goes on to tout their excitement over signing up 250,000 new subscribers in Kivu, Democratic Republic of the Congo in only 3 months. Needless to say, Tigo expects to create long-term value from this success and the company also hopes to apply a similar method of user acquisition to other regions.

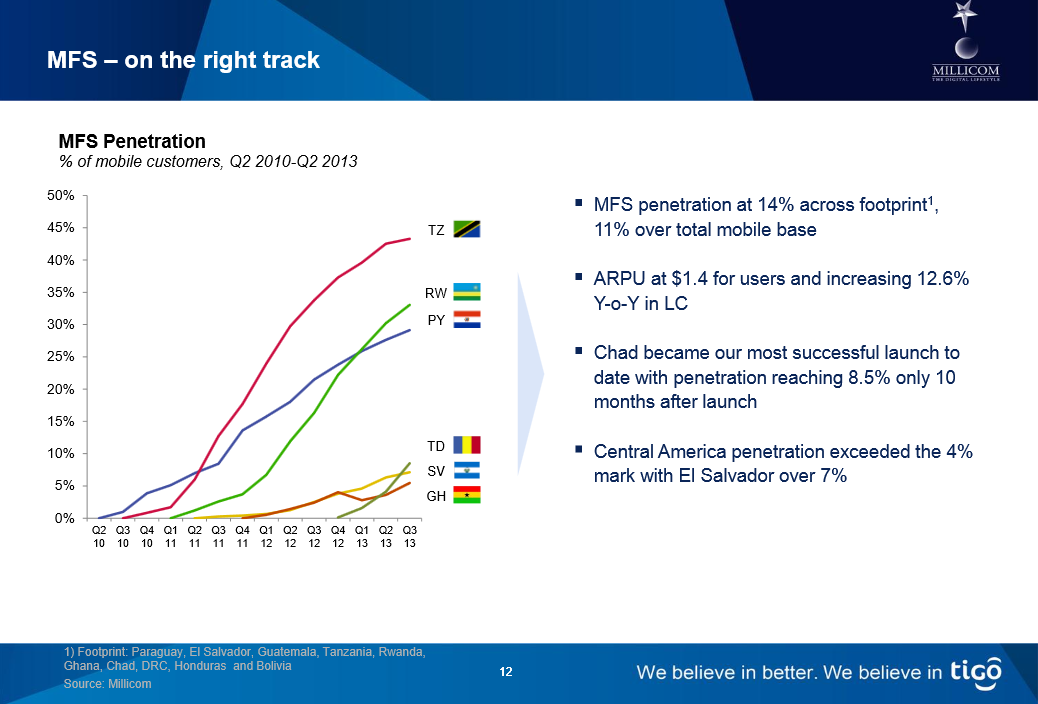

Perhaps most notable is how African is utilizing mobile money services. After launching mobile financial services in Tanzania three years ago, the service has plateaued around 45%, suggesting most Tigo Tanzania subscribers who wish to use mobile money are doing so. The service was launched in Chad (where Tigo has 50% market share) and experienced a record-setting 8.5% adoption by Tigo users in only 10 months.

Rapid mobile financial service adoption in Chad and nearly 50% MFS usage in Tanzania. Click to enlarge. {Millicom}

Tigo highlights from July-August-September 2013:

- African revenue (USD 257 million) was up by USD 12 million year-over-year (4%)

- African earnings (EBITDA) stood at USD 62 million (down by 32% year-over-year due to tax situations)

- African average revenue per user (ARPU) was stable at USD 4 (and has only declined by 6% in a year)

- Millicom has 20 million mobile customers and 5,183 cellsites across its African footprint

- 1 million African mobile customers were added in 3 months

- 250,000 new customers were added in Kivu province, DR Congo in just 3 months

- Mobile financial revenue almost grew by 100% across all markets

- 43% of Tanzanians using Tigo use financial services

- In less than 10 months, 8.5% of Chadians using Tigo are using mobile financial services

- Obstacles included taxes (especially in Africa) and increased marketing to grow mobile data and payments

- Price competition in Tanzania (following a March 2013 reduction in interconnection rates and a June 2013 SIM registration enforcement) caused subscriber numbers to decline

- Market position is #1 in Chad; #2 in other markets (except tied for 2nd in Ghana)

- Market share ranges from 53% in Chad to around 30% in DRC, Rwanda, Senegal, and Tanzania (18% in Ghana)

- Jumia, the fast-growing online retailer (of which Millicom has heavily invested) is winning awards and expanding its footprint

- New launches included Jovago (hotel booking), Kaymu (online marketplace), Easy Taxi, HelloFood

Of course, the success of one telecoms operator doesn’t necessarily mean the same for all. Operational costs (ie. building out network infrastructure) are often hefty and competition is fierce, meaning promotions and cost-cutting measures can draw subscribers over to another brand. In addition, subscription trends and costs can vary from quarter to quarter depending on regulatory decisions and new laws (taxation, for example).

Twitter

Twitter Facebook

Facebook Pinterest

Pinterest